Pay As You Go

For Small Businesses and Startups

Users only pay for what they use.

<50 employees

Create the perfect credit experience. Design seamless application journeys for your business and consumer customers.

We partner with leading financial institutions and credit bureaus to provide comprehensive and reliable credit decision solutions.

Our Credit Portfolio Dashboard provides a real-time, at-a-glance view of your portfolio's health, helping you proactively manage risk and make smarter financial decisions.

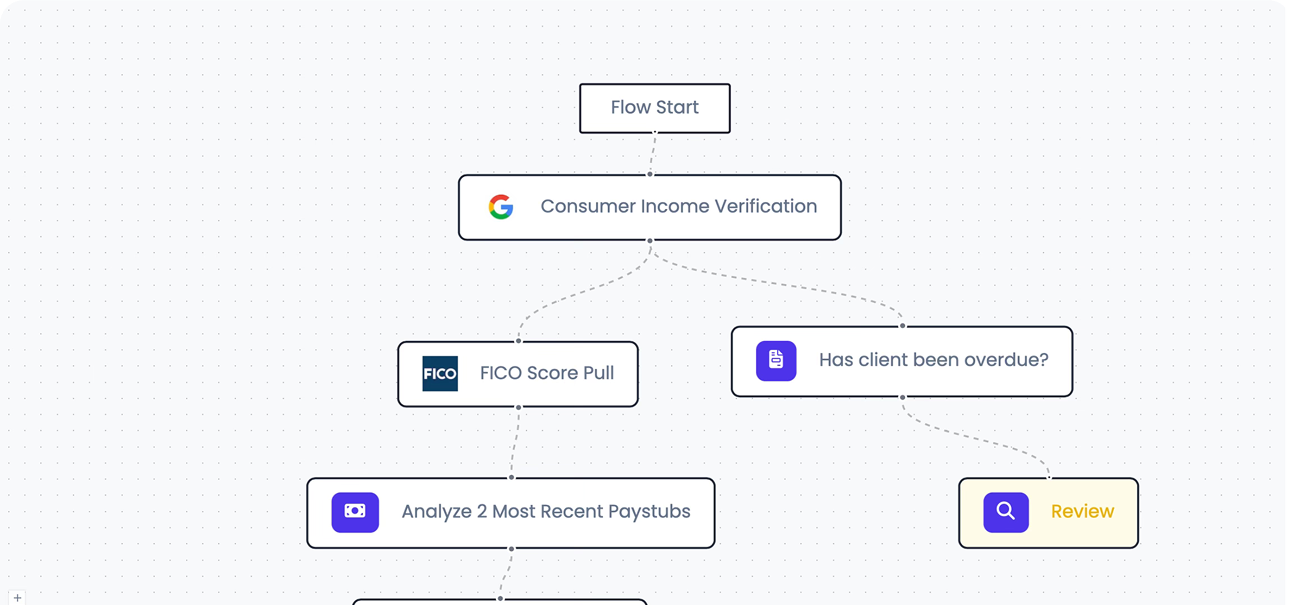

Credissence's customizable risk and credit workflow engine lets lenders and businesses build their approval process from the ground up, defining everything from application questions to automated decision rules for any type of customer.

Credissence streamlines B2B commercial credit approvals with its customizable decision engine.

Credissence accelerates B2C credit approvals with its customizable and automated decision engine.

Credissence helps B2B businesses automate their trade credit approval process for faster.

Seamlessly power your own platform by embedding our sophisticated, automated credit decision engine directly into your existing applications and internal systems. Our flexible and easy-to-use API is designed for rapid integration.

Creditsource seamlessly integrates data from top credit bureaus, identity verification (KYC/KYB) and AML/Fraud tools, enriching every application with powerful AI insights for a complete and confident decision.

Our No-Code Ratio Builder lets you create and automate custom financial calculations without code. Using its intuitive visual interface, drag and drop financial data to construct the exact ratios your business needs for accurate risk assessment.

For Small Businesses and Startups

Users only pay for what they use.

<50 employees

Mid-Market/ Medium-Sized Enterprises

Scale with a 12 month commitment

50-1000 employees

Enterprise/Large Corporations

Flexible plan with custom solutions

1000+ employees

As someone self-employed with variable income, most lenders couldn't approve me. But Lipaworld, using Credissance, looked beyond the traditional score to see my full financial picture. I was finally approved fairly, and thanks to that loan, I've been able to grow my business and build for the future.

Qualifying prospects is crucial in B2B sales—not just to close deals, but to ensure clients can meet payment obligations. Credissance helps sales teams quickly assess creditworthiness without messy spreadsheets, so they can focus on selling and serving clients.

AI/ML tools for Credit and Fraud Detection

AI/ML tools for Credit and Fraud Detection

Identity Verification Solutions

Real-time Fintech Data Solutions

Credit score, reporting and monitoring alerts

Credit score, reporting and monitoring alerts

Credit score, reporting and monitoring alerts

We integrate with 7 leading service providers across AI/ML tools, identity verification, fintech data, and credit reporting to provide comprehensive financial decision solutions.

In relation to websites and apps, UI design considers the look, interactivity of the making product. It's all about making sure that the user interface.

Nor is there anyone who loves or pursues or desires to obtain pain itself, because it is pain, but occasionally cumstances occur in which toil and pain can which toil and pain can procuresteady steady.

The timeline for building a new website typically ranges from 2-12 weeks, depending on the complexity, features required, and the amount of content. Simple websites can be completed in 2-4 weeks, while complex e-commerce or custom applications may take 8-12 weeks or more.

To get started, we'll need your business requirements, brand guidelines, content (text and images), preferred design style, functional requirements, and any specific features you want. We'll also need access to your domain and hosting if you have them.

A soft launch involves releasing your product or service to a limited audience first. Start with beta testing, gather feedback, make improvements, then gradually expand your reach. This approach helps identify issues early and refine your offering before the full launch.

Our trial period allows you to test our services risk-free for 14 days. You'll have access to all features, support, and can cancel anytime. No credit card required upfront, and you can upgrade to a paid plan whenever you're ready.

This section contains 5 frequently asked questions about our services, including information about warranties, timelines, requirements, business guidance, and trial options.

Join 13k+ teams who have streamlined the way they manage projects and collaborate remotely.

This section invites users to join our platform with options to get started immediately or request a free demonstration. Over 13k+teams are already using our services.